Open Banking is one of the modern methods adopted by the banking industry wherein third-party services providers are involved in payment and financial services. These service providers can offer their services by accessing data from banks and FIs using APIs or application programming interfaces. This form of banking is gaining popularity as it facilitates faster and more secure transactions, is remotely available, and can be accessed from across the world.

Open Banking has been a part of the disruptive technology culture that has hit the financial service industry. As it puts the entire control in the hands of the consumer, it is more powerful than intended. The fact that open banking helps create value add-ons, for example understanding consumer buying habits and their financial situation to empower customers to make better decisions and budget optimally.

This article will talk of how open banking can help the pensions industry. It is imperative to say that the technology can be used by the industry but the responsibility of using it is completely on the players of the industry.

This article will talk of how open banking can help the pensions industry. It is imperative to say that the technology can be used by the industry but the responsibility of using it is completely on the players of the industry.

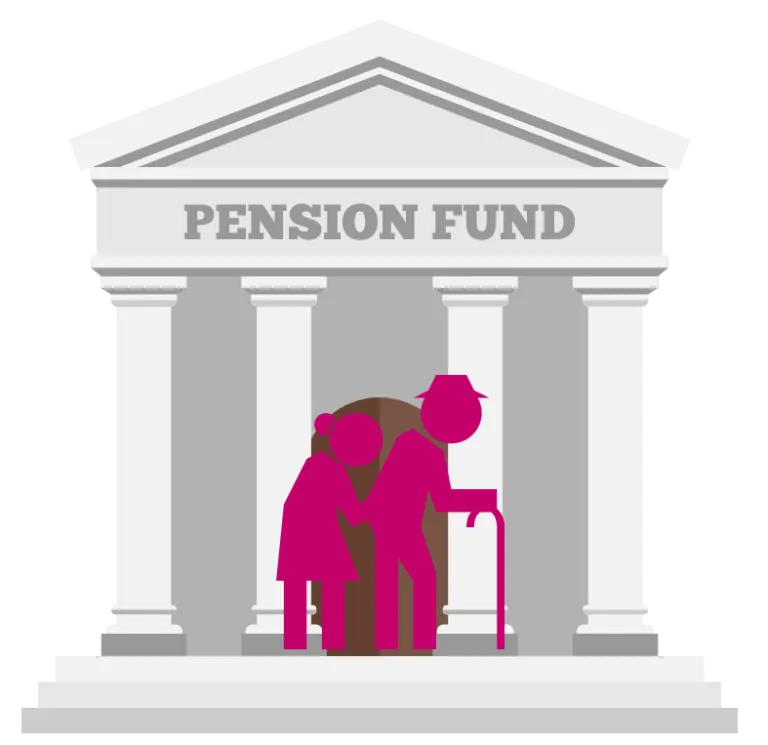

What is Pension?

Before we explore how open banking is and can make a difference to the pensions industry, let us understand what a pension fund is. It is a fund where capital is accumulated so that it can be paid out to employees on retirement at the end of their careers as a pension.

Here are the ways that Open Banking can be used in the pensions industry:

-

Open Banking is helping the pension industry go paperless.

Open Banking is helping the pension industry go paperless.Open banking is a technology that helps makes the countless back-office processes related to opening pension accounts a hassle-free affair. Part of it is because customers can use their phones to open their pension accounts without the need to involve papers and documents. Take the case of Bank of India which has recently joined hands with the Provident Fund Regulatory and Development Authority (PFRDA), the pension fund regulator in India that enable customers to use their phones to open their National Pension System or NPS accounts. With the help of the third-party app, customers can scan a QR code that will take them directly to the homepage of NPS. All they need to fill in is their Aadhaar details and their photos and other details will automatically be updated from Digi Locker.

-

Open banking makes payments and contributions a simple process.

Customers who need to have their payments initiated can take the help of the pension management app without leaving the app, they can select the concerned bank from the list. The app then directs the customer to the banking service provider’s app. The need for manual presence or transaction is completely removed which makes it all very convenient. Customers also are spared from queuing up at banks for depositing money in their pension accounts. Customers can also choose to automate their savings. Open Banking analyses the balance in the bank account of the customer every month and if there is any money left, it is automatically transferred to the pensions account. It works like auto-enrolment with the objective that all concerned benefit from pension schemes.

-

Account Information Services

Open Banking helps customers have a better view of their financial standing. It helps them get valuable insights with all the consolidated information in one place. This is done through AIS or Account Information Services. AIS simply integrates banking apps and other financial services apps so that customers get a holistic view of their financial condition in one go. This means that they can see the balance in their pension account live and in real-time.

-

Keeping a track of old pensions

When customers change jobs, they can very well lose track of their old pension funds and accounts. But with the help of this new technology, it is possible to consolidate all the pension funds and stay informed. This means that users are in control as they have information not just about the pensions in their existing workplace but also all the old pension accounts. They can initiate the transfer of all the old pensions to a single account – that of the present employer.

Users no longer need to remember the pension policy numbers or the old employer/provider’s name and other details. The entire information is available in the apps thanks to open technology. The transfer of pension funds also becomes faster for all the stakeholders including pension providers. It also facilitates quicker processing time for providers as customers no longer need to engage with the customer service department to source information about their pension account and other details. This leaves them more time to focus on processing pension transfers and disbursements.

Conclusion

Open Banking has evolved pretty fast in the last couple of years. In India, 2021 can rightly be called the ‘Year of Open Banking.’ Even as Banking-as-a-Service gained momentum in the country, most financial institutions including banks and pension providers are gradually adopting this new-age technology to optimize their services.